Pradhan Mantri Mudra Yojana:- The Pradhan Mantri Mudra Yojana (PMMY) is a government initiative launched in April 2015 to empower small businesses by providing loans up to Rs 20 lakh. This scheme was designed to simplify loan access for small entrepreneurs, especially those struggling to secure collateral-based loans. The PMMY makes it easier for individuals to obtain funding without guarantees, boosting small businesses and self-employment across India.

Table of Contents

Key Objectives of the Pradhan Mantri Mudra Yojana

The primary aim of PMMY is to foster economic growth by supporting small business ventures. By making loans more accessible, PMMY seeks to:

- Encourage self-employment and small business creation.

- Improve the ease of obtaining loans for those without collateral.

- Promote financial inclusion for underserved communities.

Latest Update: Budget 2024

The Budget 2024 introduced a significant update for PMMY. Entrepreneurs who have successfully repaid their loans in the ‘Tarun’ category are now eligible for an increased loan limit, raised from Rs 10 lakh to Rs 20 lakh. This enhancement enables existing and new entrepreneurs to scale their businesses further.

PMMY Loan Categories

Under the Mudra Yojana, loans are divided into three categories:

- Shishu Loan: Loans up to Rs 50,000 for early-stage businesses.

- Kishor Loan: Loans ranging from Rs 50,000 to Rs 5 lakh for expanding businesses.

- Tarun Loan: Loans ranging from Rs 5 lakh to Rs 20 lakh for well-established businesses.

Interest Rates and Repayment

Interest rates on PMMY loans vary by institution, with a general benchmark of 12%. The repayment period for Mudra loans is flexible and can extend up to five years.

Benefits of Mudra Cards

Mudra Cards work like debit cards for loan holders, enabling easy withdrawals to manage business capital needs. Key features include:

- Cash withdrawals from ATMs up to the approved limit.

- Payments at merchant terminals across India.

- Digital transactions for enhanced business convenience.

Eligibility Criteria for PMMY

To apply, an applicant must:

- Be at least 18 years old.

- Be involved in non-farm income-generating activities, such as trade, manufacturing, or services.

- Have a valid ID and address proof.

Required Documents for Application

Essential documents include:

- Completed Mudra application form.

- Identification proof.

- Address verification.

- Bank account statement (last 6 months).

- Business plan and quotation.

- Proof of business ownership.

Advantages of the Mudra Yojana

PMMY offers numerous benefits, including:

- No collateral requirement.

- Access to loans through multiple banking channels, such as public sector banks, private banks, and micro-finance institutions.

- Special provisions like the Mahila Udyam Scheme for women entrepreneurs.

Lending Activities Supported by PMMY

Mudra loans support various income-generating activities, such as:

- Small business operations, vendor loans, and shopkeeping.

- Equipment financing and commercial transport loans.

- Non-farm activities, such as fish farming and poultry.

How to Apply for a PMMY Loan

To apply, follow these steps:

- Visit the nearest bank or financial institution offering Mudra loans.

- Complete the Mudra Yojana application form with personal and business details.

- Submit the form along with required documents for verification.

- Upon approval, the loan amount will be disbursed directly to your account within a month.

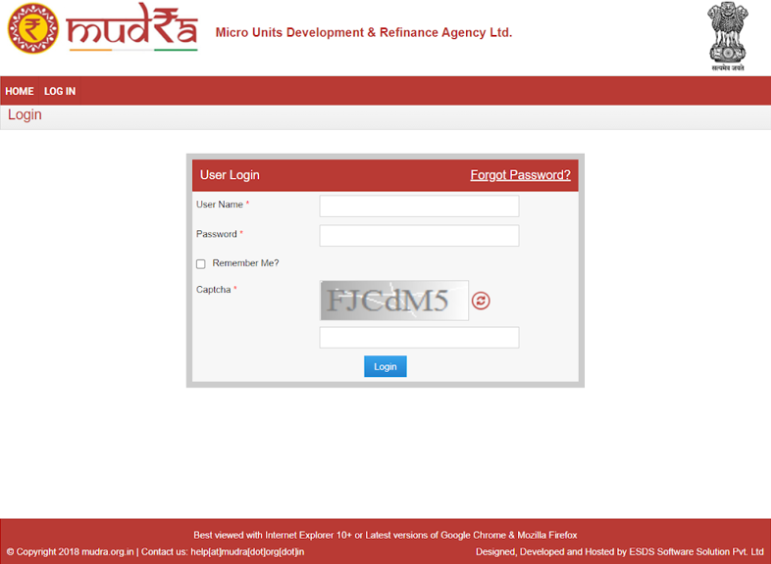

How to Access the PMMY Portal

- Visit the official Pradhan Mantri Mudra Yojana website.

- Navigate to the PMMY portal login link.

- Enter your login credentials (username, password, and captcha).

- Access your PMMY account for further details or assistance.

Downloading the Toll-Free Contact Number

- On the official Mudra Yojana website, go to the Contact Us section.

- Download the list of toll-free numbers for assistance across various states.

PMMY and Atmanirbhar Bharat Abhiyaan

Under the Self-Reliant India initiative, those with Shishu loans received a 2% interest subsidy for 12 months, fostering additional support for micro-entrepreneurs.

Pradhan Mantri Mudra Loan Yojana is an initiative by the Government of India to provide easy financial support to small and micro-entrepreneurs, promoting self-employment and aiding in economic development. This scheme, introduced in 2015, is part of the Micro Units Development and Refinance Agency (MUDRA) and primarily supports non-corporate, non-farm small and micro-enterprises.

Pradhan Mantri Mudra Yojana: Beneficiaries

| Financial Year | No. of PMMY Loans sanctioned in a year | Loan Sanctioned amount (in Rs) | Loan disbursed amount (in Rs) |

| 2015-2016 | 34880924 | 137449.27 crore | 132954.73 crore |

| 2016-2017 | 39701047 | 180528.54 crore | 175312.13 crore |

| 2017-2018 | 48130593 | 253677.10 crore | 246437.40 crore |

| 2018-2019 | 59870318 | 321722.79 crore | 311811.38 crore |

| 2019-2020 | 62247606 | 337495.53 crore | 329715.03 crore |

| 2020-2021 | 50735046 | 321759.25 crore | 311754.47 crore |

| 2021-2022 | 53795526 | 339110.35 crore | 331402.20 crore |

| 2022-2023 | 4206708 * | 29894.08 crore * | 28994.94 crore * |

| Total | 349361060 | 1921636.91 crore | 1868382.28 crore |

Pradhan Mantri Mudra Yojana (PMMY)

The scheme offers three types of loans categorized as Shishu, Kishor, and Tarun, each suited to different stages of business development:

- Shishu Loan: Provides loans up to Rs. 50,000 for new startups and small businesses.

- Kishor Loan: For businesses seeking to expand, with loans between Rs. 50,001 to Rs. 5 lakh.

- Tarun Loan: For larger business needs, providing loans between Rs. 5 lakh and Rs. 10 lakh.

Interest Rate and Loan Tenure

The interest rate for Mudra loans varies, as it is not fixed by MUDRA itself. Instead, banks and lending institutions set the interest rate within RBI’s guidelines, often around 8% to 12% depending on the institution and loan amount. Loans are typically provided with a repayment period of up to five years.

Online Application Process

The application for Mudra loans can be completed online through most major banks and financial institutions:

- Visit the official website of your bank or the MUDRA scheme portal.

- Complete the application form with details such as business type, purpose of loan, amount required, and applicant information.

- Upload necessary documents such as ID proof, address proof, business plan, and bank statements.

- Submit the form, and the bank will verify your information and, upon approval, disburse the loan within a few weeks.

Applying for the Pradhan Mantri Mudra Loan Online

To apply for a Mudra loan of Rs. 50,000 online (Shishu category), follow these steps:

- Eligibility: Ensure your business is eligible; the loan is for micro-enterprises, startups, and self-employed individuals.

- Choose your bank: Most public and private sector banks, including SBI (State Bank of India), offer Mudra loans.

- Submit required documents: Prepare your business plan, financial projections, and any other documentation required by the bank.

- Fill out the application form: Available on the bank’s official site or the PMMY portal.

- Verification and Disbursement: Upon submission, the bank will assess your application and creditworthiness, and the approved amount will be transferred directly to your account.

Pradhan Mantri Mudra Loan Application Form

The application form can be obtained from participating banks or downloaded from their websites. It will include sections for business details, loan purpose, loan amount, applicant information, and details of the business plan. Required documents include:

- Identity proof (Aadhar, PAN, Voter ID)

- Address proof

- Business plan

- Quotations for equipment (if applicable)

- Bank statements

Pradhan Mantri Mudra Yojana and SBI

The State Bank of India (SBI) provides Mudra loans to eligible businesses, and applicants can apply either through an SBI branch or online. SBI Mudra loans typically follow the same guidelines as the general scheme, but applicants should verify the interest rates, as these can vary by bank and region.

Contact Information and Support: For any questions, users can contact the MUDRA support team at help@mudra.org.in or visit the MUDRA website.

Contact Information for PMMY

For queries, email help@mudra.org.in or refer to the toll-free numbers on the PMMY website. This scheme has catalyzed financial empowerment for millions, helping individuals achieve self-reliance and entrepreneurial success. The Pradhan Mantri Mudra Yojana continues to stand as a pillar of support for aspiring business owners, encouraging economic growth and innovation.

Here’s an FAQ for the Pradhan Mantri Mudra Yojana (PMMY)

1. What is the Pradhan Mantri Mudra Yojana?

The Pradhan Mantri Mudra Yojana (PMMY) is a scheme launched by the Government of India to provide financial support to non-corporate, non-farm small and micro-enterprises. It aims to promote entrepreneurship and employment by offering loans at low interest rates through banks, microfinance institutions, and other financial institutions.

2. What are the different loan categories under Mudra Yojana?

There are three categories of loans under the Mudra Yojana:

- Shishu: Loans up to Rs. 50,000 for small, early-stage businesses.

- Kishor: Loans from Rs. 50,001 to Rs. 5 lakh for businesses seeking growth.

- Tarun: Loans from Rs. 5 lakh to Rs. 10 lakh for more established businesses seeking expansion.

3. Who is eligible to apply for a Mudra loan?

Eligibility requirements include:

- Indian citizens aged 18 and above.

- Proprietors or partners of micro and small businesses.

- Individuals in non-farm sectors, such as manufacturing, trading, and services.

4. What documents are required for applying?

Typically, required documents include:

- Identity proof (Aadhar, PAN card, Voter ID)

- Address proof

- Business plan or project report

- Financial statements and bank statements

- Proof of business ownership

5. How can I apply for a Mudra loan?

Applications can be submitted:

- Online: Through participating banks’ official websites or the Mudra Yojana portal.

- In Person: Visit a branch of a participating bank (such as SBI, PNB, etc.) with all required documents.

6. What is the interest rate for Mudra loans?

The interest rate for Mudra loans typically ranges from 8% to 12%, depending on the loan amount, applicant profile, and lending institution.

7. Is there a processing fee for Mudra loans?

Most Mudra loans do not carry any processing fee, especially under the Shishu and Kishor categories. However, banks may have different policies, so it’s recommended to confirm with your bank.

8. What is the repayment period for Mudra loans?

Mudra loans generally come with a repayment period of up to 5 years. The exact tenure depends on the loan amount and the business’s financial plan.

9. Can I apply for a Mudra loan online?

Yes, many banks offer an online application process for Mudra loans. Simply visit the website of a participating bank, fill out the Mudra loan application form, and upload the required documents.

10. How can I apply for a Mudra loan of Rs. 50,000?

To apply for a Rs. 50,000 loan, select the Shishu category and submit your application either online or at a participating bank with the required documents. This loan amount is intended for small, early-stage businesses.

11. Are there any subsidies available for Mudra loans?

While there is no direct subsidy on Mudra loans, the scheme offers competitive interest rates and does not require collateral, which reduces costs for borrowers.

12. Which banks offer Mudra loans?

Mudra loans are available through most major public sector banks, private banks, regional rural banks, cooperative banks, and microfinance institutions across India. Popular banks offering Mudra loans include State Bank of India (SBI), Punjab National Bank (PNB), and Bank of Baroda (BOB).

13. Can a person with a poor credit history apply for a Mudra loan?

While credit history is an important factor in the approval process, some banks may still consider applications from those with less-than-perfect credit scores based on other eligibility criteria.

14. Where can I get help if I have questions about Mudra loans?

For additional information, applicants can visit the official MUDRA website or contact customer support via email at help@mudra.org.in.